Source: www.english.globalarabnetwork.com

Doha Bank and Ahlibank are among lenders seeking to compete with government-controlled Qatar National Bank to fund the $130bn of infrastructure the country needs before hosting the 2022 soccer World Cup, Global Arab Network reports according to local media.

Doha Bank, Qatar’s fifth-biggest by assets, may raise as much as QR5.81bn ($1.6bn) from selling shares to boost lending, the bank said mid-September. Ahlibank plans to increase capital by 20% through a rights issue priced at QR30 a share, it said early last month.

Doha Bank, Qatar’s fifth-biggest by assets, may raise as much as QR5.81bn ($1.6bn) from selling shares to boost lending, the bank said mid-September. Ahlibank plans to increase capital by 20% through a rights issue priced at QR30 a share, it said early last month.

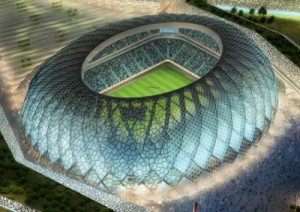

Qatari banks are preparing to support new building projects including a rail network, new port and soccer stadiums and sporting facilities.

“To sit down and put your offer on the table, you have to have the capital base,” Ahlibank chief executive officer Moataz el-Rafie said on October 7. “With the larger capital, you have a larger lending capacity where you can compete more effectively in the larger deals.”

QNB, bigger than all the nation’s other lenders combined, experienced the fastest loan growth of the Qatari banks over the past year. The yield on its 3.375% bond, maturing in February 2017, fell 107 basis points over the past six months to 2.16% on Tuesday, a record low.

Doha Bank’s 3.5% bonds maturing in March 2017 fell 95 basis points to 2.64%, also a record low.

Over the same period, the average yield on GCC financial services debt has fallen 83 basis points to 3.35%, according to the HSBC Nasdaq Dubai GCC Conventional Financial Services US Dollar Bond Index.

Doha Bank “lost market share this year partly because they have a lower capital base,” said David Mikhail, a Cairo-based analyst for Beltone Securities Brokerage,.

“They are simply raising capital to maintain their market share ahead of significant construction activity and project tendering that will gain momentum in 2013 and 2014.”

Qatari banks’ lending is expected to accelerate as work begins on new construction projects in the coming years. Tunneling contracts for a planned $35bn metro and rail network will be awarded next year, when work is also set to begin on the first of nine new stadiums and sporting facilities costing $9bn.

The country is also building new roads, a $7.4bn port, a city for 200,000 people and a new airport.

Qatar’s three-month interbank offered rate has risen six basis points this year to 1.23% yesterday, compared with a drop of 22 basis points to 1.3% for the equivalent rate in the United Arab Emirates, where loan growth was 2.7% in the first eight months.

Credit facilities issued by Qatari banks, including loans, jumped 33% in August from a year earlier, with lending to the public sector surging 65%, according to central bank data. Lenders’ ratio of credit to loans widened to 114% in August, from 105% a year earlier.

Doha Bank and Ahlibank’s income from lending has fallen as they brace for tighter capital requirements under the Basel III rules for lenders. Doha Bank’s third-quarter interest income fell 9.6 since 2010 and Ahli’s dropped 12%, according to data compiled by Bloomberg.

QNB, Masraf Al Rayan, Qatar Islamic Bank and Qatar International Islamic Bank reported an increase in interest income over the same period.

QNB posted a 42% growth in loans in the past year, according to data compiled by Bloomberg. Its $66.5bn loan book at the end of September was five times bigger than Commercialbank of Qatar, its nearest competitor.

“QNB is much better positioned,” Jaap Meijer, head bank analyst at Arqaam Capital Ltd in Dubai, said in an October 14 e-mail. “QNB’s capital base is about five times Doha Bank’s.” More info